puerto rico tax incentive program

4 corporate tax rate for Puerto Rico services companies. The Tax Incentives Office provides assistance to the Economic Development Bank of Puerto Rico in evaluating the loan applications for the development of tourism activities.

New Puerto Rico Tax Incentives Code Act 60 Explained 20 22

In addition to attract investment Puerto Rico enacted two tax acts Act 20 and Act 22.

. Known as the Puerto Rico Incentive Code to. Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS INCENTIVE PROGRAMS. Thousands of Americans have already moved to the US-owned Caribbean island under the program to take advantage of Act 60s tax benefits with Puerto Ricos stunning beaches and vibrant culture serving as two added incentives in favor of the move.

Ii a total or partial exemption on any tax imposed by the Government of Puerto Rico or one of its subdivisions including municipalities or. Puerto Rico residents only pay PR taxes on their income sourced on the island. Iii a different term or condition with respect to eligible activities.

Incentives for export activities or to attract investment to develop the Puerto Rico economy in a way that is profitable for Puerto Ricos Government tourism manufacture for exportation exportation services and international investment. Then under a law referred to as Act 60 formerly Act 20 and Act 22 Puerto Rico has enacted several tax incentives the two most popular of which are as follows. Puerto Ricos goal is to grow Puerto Rico into a hub for international business services.

This is done through the formation of investment capital funds aimed at investing in companies that do not have access to public markets and establish the applicable. Also the 7 fixed income tax rate on said income will be determined. There are various other tax incentives that aim to bring specific types of businesses to the island or in the case of the Young Entrepreneurs foster the talent already on.

362 of December 24 1999. The same will be used to inform the income derived by a Film Entity under Act No. And if it the income is sourced in Puerto Rico it would escape tax in the US.

Press question mark to learn the rest of the keyboard shortcuts. Puerto Rico offers tax incentives packages which can prove attractive to US mainland and other countries companies. Those two tax acts offer low to no taxes on certain types of income.

We have the ability to streamline the process of obtaining your Export Goods and Services tax incentive as we have for many other business owners. One of the most well-known Puerto Rican tax incentives the Individual Resident Investor tax incentive is available to any person who was not a resident of Puerto Rico for the 10 tax years preceding July 1 2019 and who becomes a resident before December 1 2035. Press J to jump to the feed.

Under the Puerto Rico Incentives Programs. A Puerto Rican corporation thats engaged in certain types of service businesses only pays Puerto Rican tax of 4. The two well-known Puerto Rican tax incentives are Export Services formerly Act 20 and Individual Resident Investor formerly Act 22 but they arent the only tax incentives Puerto Rico offers.

To promote the necessary conditions to attract investment from industries support small and medium merchants face challenges in medical care and education simplify processes optimize and provide greater transparency Act 60-2019 was signed which establishes the new Puerto Rico Incentive Code. Puerto Rico Incentives Code Act 60 of 2019 The Export Services Act PR Act 60 Chapter 3 formerly Act 20 The Individual Investors Act PR Act 60 Chapter 2 formerly. Puerto Ricos Act 185 Tax Incentive Program The purpose of the Act 185 tax incentive is to establish the Private Equity Fund Act to promote the development of private capital in Puerto Rico.

This is one of Puerto Ricos most popular tax incentive programs. FINANCIAL STATEMENTS REQUIREMENT If the entity had a business volume related to its fully taxable operations of more than 1 million the. Feature films short films documentaries television programs series in episodes mini-series music videos national and international commercials video games and.

Act 20 Export Services Act. Castellanos is personally supervising all legal and consulting work done by Castellanos Group PSC related to Puerto Rico Tax Incentives including. Now known as Chapter 3 of the Incentives Code Puerto Ricos Act 20 was originally known as the Export Services Act.

These include a fixed corporate income tax rate one of the lowest in comparison with any US jurisdiction various tax exemptions and special deductions training expenses reimbursement and special tax treatment for pioneer activities. The legislation allows Puerto Rico to offer qualifying businesses that export services from the island nation the opportunity to cut their corporate tax rate to a mere 4. An open forum for the Puerto Rico Act 20 22 60 Tax Incentive community and those interested in making the move.

Make Puerto Rico Your New Home. 100 exemption from municipal license taxes and other municipal taxes. It means that under Puerto Rico Incentives Code 60 if an individual is granted Puerto Rico tax exemption under the act long term gains as a result of investments made after becoming a resident will be exempt from tax in Puerto Rico.

22-2016 provides up to 11 energy credit if the tourism activity is endorsed by the PRTC and complies with the requirement stated in this form. The tax incentive program which was first created as the 2012 Act 20 and Act 22 programs could not. The fiscal impact of approximately 590M in credits and monetary stimulus excluding tax exemptions and prime taxes.

To be eligible investors must donate 10000 to nonprofit entities in Puerto Rico. I a preferred tax rate. 90 exemption from municipal and state taxes on property.

Faqs Tax Incentives And Moving To Puerto Rico

Guide To Income Tax In Puerto Rico

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

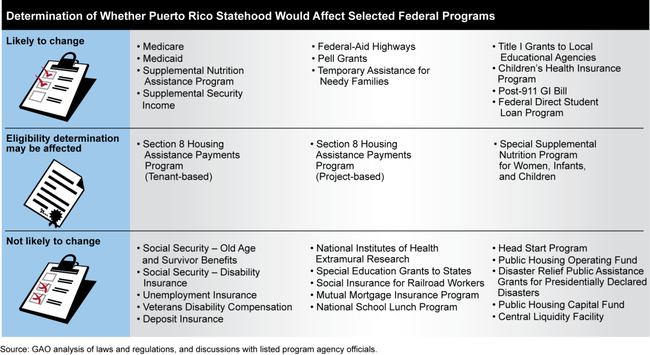

Puerto Rico Information On How Statehood Would Potentially Affect Selected Federal Programs And Revenue Sources U S Gao

Guide To Income Tax In Puerto Rico

Do Puerto Ricans Pay U S Taxes H R Block

Act 20 Act 22 Puerto Rico Tax Incentives Relocatepuertorico

Us Tax Filing And Advantages For Americans Living In Puerto Rico

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Tax Incentives Is Relocating To Puerto Rico The Right Move For You

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

![]()

Taxation Puerto Rico Move To Puerto Rico And Pay No Capital Gains Tax

Guide To Income Tax In Puerto Rico

Puerto Rico Tax Haven Is Alluring But Are There Tax Risks

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22