nebraska vehicle tax calculator

Once the msrp of the vehicle is established a base tax set in nebraska motor vehicle. How to Calculate Nebraska Sales Tax on a Car.

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Your average tax rate is 1198 and your marginal.

. The average effective property tax rate in nebraska is 161 which ranks among the 10 most burdensome states in the country when it comes to real estate taxes. Your purchase will be charged to your Nebraskagov subscriber account. If you make 70000 a year living in the region of Nebraska USA you will be taxed 12680.

To use the calculators above including the car payments calculator NJ youll usually need to enter some basic information about the vehicle you plan to purchase. Average DMV fees in Nebraska on a new-car purchase add up to 67 1 which includes the title registration and plate fees shown above. This is less than 1 of the value of the motor vehicle.

1st Street Papillion NE 68046. Nebraska charges a motor vehicle tax and a motor vehicle fee that is based upon the value and weight of the vehicle being registered so the charges will vary. Nebraska Income Tax Calculator 2021.

If you dont want to create a TxT account you can still use this online option to renew. Maximum Local Sales Tax. Complete the Vehicle Registration Renewal application.

You can calculate the sales tax in Nebraska by multiplying the final purchase price by 055. Subsequent brackets increase the tax 10 to. The information you may need.

If you are registering a motorboat. Nebraska State Sales Tax. The nebraska state sales and use tax rate is 55.

Sarpy County Courthouse Campus 1210 Golden Gate Drive Papillion NE 68046 402-593-2100 Sarpy County 1102 Building 1102 E. If you are not a Nebraskagov subscriber sign up. This is because the first bracket is fairly wide 0 - 3999 and has only a 25 tax when new.

Nebraska Documentation Fees. All data based on your calculation. Average Local State Sales Tax.

The net price of 38250 equals the. Maximum Possible Sales Tax. Send the renewal notice a copy of your.

View the Nebraska state fee estimator to verify your registration cost and use our DMV Override to adjust the calculator. Vehicle Information required Motor Vehicle Tax calculations are based on the MSRP Manufacturers Suggested Retail Price of the vehicle. This service is intended for qualified business professional.

You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code. In Nebraska the sales tax percentage is 55 meaning. The calculator will show you the total sales tax amount as well as the county city.

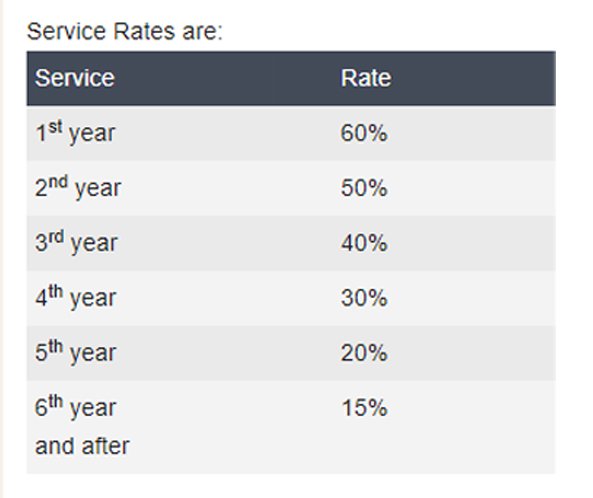

To register an apportioned vehicle vehicles over 26000 pounds that cross state lines contact the Department of Motor Vehicles Motor Carrier Services. Sales tax is calculated using the percentage of the items value that must be paid in addition to the full price of the item. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

For example lets say that you want. 425 motor vehicle document fee.

Your Guide To The United States Sales Tax Calculator Tax Relief Center

Bangalore Road Tax Calculation For New Vehicle Team Bhp

Nebraska Income Tax Ne State Tax Calculator Community Tax

How To Calculate Sales Tax And Vehicle Registration Fees In Wyoming

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Rental Taxes Reforming Rental Car Excise Taxes

Motor Vehicles Douglas County Treasurer

Are Personal Injury Settlements Taxable In Nebraska Welsh Welsh

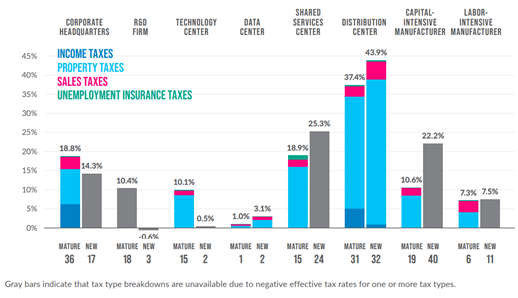

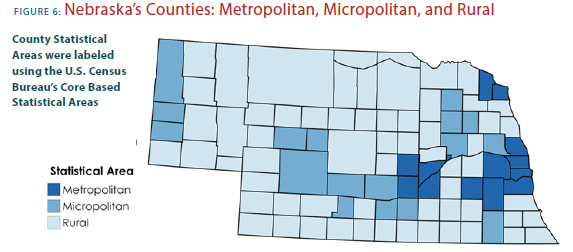

5 Essential Steps To Reform Taxes In Nebraska

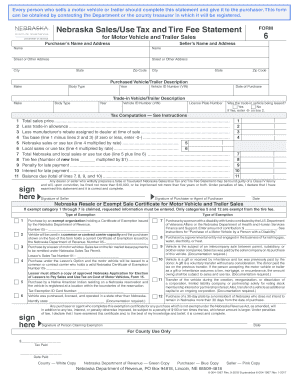

Ne Dor Form 6 2018 2022 Fill Out Tax Template Online

Sales Tax On Cars And Vehicles In Nebraska

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

Sales Taxes In The United States Wikipedia

Dmv Fees By State Usa Manual Car Registration Calculator

Dmv Fees By State Usa Manual Car Registration Calculator

Nebraska Form 2290 E File Highway Vehicle Use Tax Return

This Time It S Personal Nebraska S Personal Property Tax

Nebraska Income Tax Ne State Tax Calculator Community Tax

Registration Fees And Taxes Nebraska Department Of Motor Vehicles